Tulsa, Ok Bankruptcy Attorney: How To Avoid Bankruptcy In The Future

Tulsa, Ok Bankruptcy Attorney: How To Avoid Bankruptcy In The Future

Blog Article

How Bankruptcy Affects Employment: Insights From Tulsa Bankruptcy Attorneys

Table of ContentsTulsa Bankruptcy Lawyer: Understanding The Medical Bankruptcy ProcessTulsa, Ok Bankruptcy Attorney: Your Guide To Personal BankruptcyTulsa Bankruptcy Lawyer: Strategies For Reducing Credit Card Debt Post-bankruptcyThe Role Of Tulsa Bankruptcy Attorneys In Personal BankruptcyTulsa Bankruptcy Attorney: How To Manage Bankruptcy And Mortgage DebtTulsa, Ok Bankruptcy Attorney: Life After Bankruptcy – A Fresh StartBankruptcy Lawyer Tulsa: Navigating Child Custody And Bankruptcy IssuesBankruptcy Attorney Tulsa: Strategies For Reestablishing Credit

Bankruptcy legislation requires bankruptcy request preparers to adhere to these business practices: supply a composed contract specifying their services and fees provide created disclosures summarizing the various kinds of personal bankruptcy and the linked treatments identify themselves (in their marketing materials) as financial debt alleviation firms providing solutions under the federal bankruptcy code not bill an unreasonable cost (costs typically range from $100 to $200) not collect or manage the bankruptcy declaring fees or other court charges (you must do that on your own) submit a charge disclosure statement with the court (specifying just how much they have actually charged you for services) include their name and also social safety or tax identification number on the papers they prepare, and Do not utilize or advertise with the word "lawful" or any type of comparable term.

Bankruptcy legislation requires bankruptcy request preparers to adhere to these business practices: supply a composed contract specifying their services and fees provide created disclosures summarizing the various kinds of personal bankruptcy and the linked treatments identify themselves (in their marketing materials) as financial debt alleviation firms providing solutions under the federal bankruptcy code not bill an unreasonable cost (costs typically range from $100 to $200) not collect or manage the bankruptcy declaring fees or other court charges (you must do that on your own) submit a charge disclosure statement with the court (specifying just how much they have actually charged you for services) include their name and also social safety or tax identification number on the papers they prepare, and Do not utilize or advertise with the word "lawful" or any type of comparable term.An attorney will certainly prepare the kinds, go to the hearings, and also guide you with the procedure, and once more, many people discover it well worth the cost. If you're having a hard time to locate the money to spend for lawful help, learn what to do when you can not manage to employ a personal bankruptcy lawyer.

Overcoming Debt: How A Tulsa, Ok Bankruptcy Attorney Can Help

Below you'll discover more short articles describing exactly how bankruptcy functions. And also don't neglect that our bankruptcy homepage is the most effective area to start if you have various other questions! We completely urge research as well as discovering, but online short articles can not attend to all bankruptcy problems or the facts of your case. The best means to protect your possessions in insolvency is by hiring a local.

Submitting individual insolvency under Phase 7 or Phase 13 takes careful preparation and understanding of lawful problems. Misconceptions of the regulation or making blunders in the procedure can influence your civil liberties. Court employees and also insolvency courts are banned by legislation from using lawful suggestions. The following is a checklist of means your attorney can assist you with your situation.

Tulsa Bankruptcy Lawyer: Your Guide To Financial Freedom

Advise you under which chapter to submit. Encourage you on whether your financial obligations can be released. Recommend you on whether or not you will be able to maintain your home, vehicle, or various other residential or commercial property after you submit. Recommend you of the tax effects of filing. Encourage you on whether you ought to continue to pay lenders.

Help you with most aspects of your personal bankruptcy instance., and also the regional guidelines of the court in which the instance is filed.

Tulsa, Ok Bankruptcy Attorney: Understanding Bankruptcy And Alimony Payments

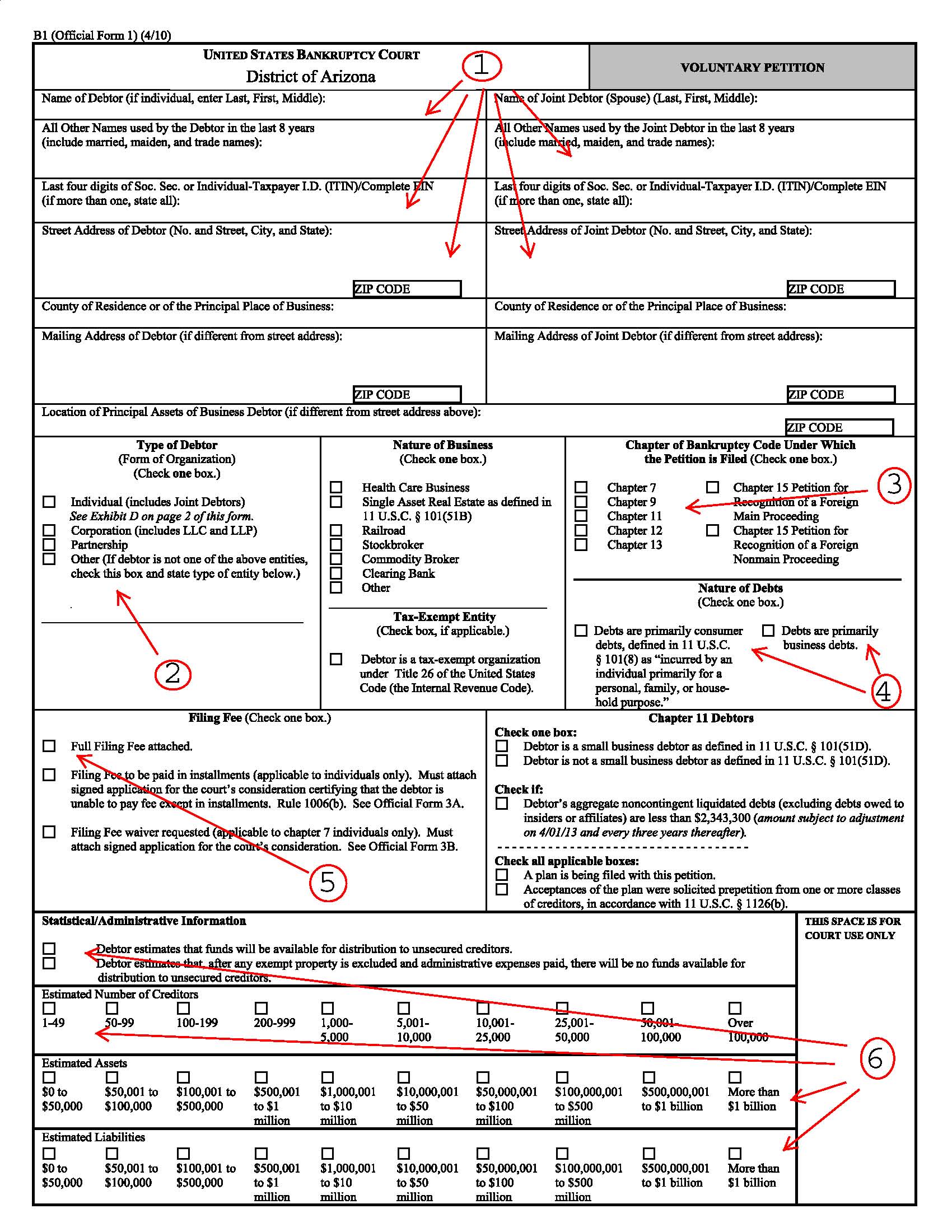

Utilize the forms that are numbered in the 100 series to file insolvency for people or wedded pairs. Utilize the forms that are phoned number in the 200 series if you are preparing a bankruptcy on Visit This Link part of a nonindividual, such as a company, partnership, or restricted obligation business (LLC).

Lots of courts require neighborhood types. You must check your court's site before filing any type of records. If you submit bankruptcy pro se, you might be supplied solutions by non-attorney request preparers. By law, preparers can only go into information right into forms. They are banned from giving legal recommendations, describing answers to legal inquiries, or aiding you in bankruptcy court.

Tulsa Bankruptcy Attorney: Expertise Matters In Complex Cases

They can not sign documents in your place or get settlement for court fees. If you require help finding a personal bankruptcy lawyer, the sources listed below may aid. If you are unable Website to pay for a lawyer, you may receive totally free lawful solutions - Tulsa bankruptcy attorney.

The lengthy answer? Lawfully, you're enabled to declare insolvency without a legal representative. The term for this is "pro se," as well as a number of those who submit for bankruptcy do it by doing this. However it's not a course we suggest. Declaring for bankruptcy is on your future funds, as well as you're not always ensured to obtain every one of your financial debts wiped tidy.

The lengthy answer? Lawfully, you're enabled to declare insolvency without a legal representative. The term for this is "pro se," as well as a number of those who submit for bankruptcy do it by doing this. However it's not a course we suggest. Declaring for bankruptcy is on your future funds, as well as you're not always ensured to obtain every one of your financial debts wiped tidy.Bankruptcy Attorney Tulsa: How To Keep Your Home During Bankruptcy

There are precise pros and also disadvantages to submitting for insolvency, as well as for some people, it's the ideal or just option available. You might not be conscious of all your options.

There are. The one that's right for you depends upon a great deal of aspects including the sort of financial debt you have, your earnings and assets, as well as your goals. An experienced personal bankruptcy lawyer can help you select the type of personal bankruptcy that's the ideal fit, and also overview you with the procedure of filing (bankruptcy attorney Tulsa).

Tulsa Bankruptcy Lawyer: The Role Of Government Agencies In Bankruptcy Cases

To certify, your earnings must be below the median for a house of your size in your state. There is some elasticity in these estimations, however if the court decides you make adequate non reusable revenue to pay a practical amount of your debts, you may not be enabled to pick this alternative.

To certify, your earnings must be below the median for a house of your size in your state. There is some elasticity in these estimations, however if the court decides you make adequate non reusable revenue to pay a practical amount of your debts, you may not be enabled to pick this alternative.For most people, the most or all of their properties are exempt from being taken. Continuing to be financial obligation is forgiven, primarily. Some sorts of financial obligation, such as tax financial obligation and also student financings, can not be discharged in all, or only in limited situations. A legal representative can be of immense assistance if you are submitting Chapter 7 personal bankruptcy.

Bankruptcy Attorney Tulsa: Understanding The Automatic Stay Provision

This will be very important in attempting to maintain your auto, your residence, or your retirement fund. You don't need to qualify to declare Chapter 11 personal bankruptcy. Both individuals as well as different sort of companies can file, and also you do not have to meet a specific earnings need. This is one of the, however, as well as it costs more to submit than various other kinds.

If you possess a service and also are taking into consideration declaring bankruptcy, it does not need to mean completion. Lots of companies that are still open today have Chapter 11 insolvencies in their past, including Chrysler and General Motors. If you're considering this kind of personal bankruptcy, an experienced personal bankruptcy legal representative can be vital in assisting you navigate this intricate procedure.

Report this page